open end loan examples

Itll always be open for you. The loan has a term of 30 years with a fixed interest rate of 575.

:max_bytes(150000):strip_icc()/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

Savings Loan Companies Vs Commercial Banks What S The Difference

They can either use all 30000 at once or let the funds sit in their account using them more sparingly.

. So how do you go about paying back an open-end loan. Suppose you have a 30 day billing cycle and your closing balance for the previous month was 35000. Depending on an individuals financial wants he may choose to use all or just a portion of his credit limit.

The main distinction between these two types of credit is in the amount of debt and how it is repaid. Open-end credit refers to any loan that allows you to withdraw and repay on a regular basis. Credit cards and lines of credits are perfect examples of open-ended loans although they both have credit restrictions.

Depending on the product you use you might be able to access the funds via check card or electronic transfer. As a result credit cards are the most popular form of open end credit in the consumer market. Using a credit card issued by a store a bank card such as VISA or MasterCard or overdraft protection are examples of open-end credit.

They have a set interest rate usually determined by the credit score and other financial information provided on the loan application. There are two types of open end credit available to borrowers. A credit card is another great example of an open end loan this time it can be either secured or an.

Open-end mortgages combine the benefits of a traditional mortgage and a HELOC. Open-End Loan Real Estate Agent Directory. Example of an Open-End Mortgage.

Lets give an example of an open-end loan. Again how you use this home equity line of credit HELOC is completely up to you. Open-end credit is a contrast to closed-end credit which is more commonly called an installment loan.

Having access to funds as soon as a payment is made on a credit card allows more flexibility. With open-end or revolving credit loans are made on a continuous basis as you purchase items and you are billed periodically to make at least partial payment. On June 7 you make a purchase of 12500 on your account.

Credit cards home equity loans personal lines of credit and checking account overdraft protection are just a few examples. Why It Is Important. A credit card is a kind of open-ended loan since the money is lent with no fixed end date.

Open-end loan agreements are also known as revolving credit accounts. The new billing period begins June 2nd. Home equity lines of credit HELOC and credit cards on the other hand are examples of open-end loans.

Borrowers benefit from open-end loan arrangements because they have more flexibility over when and how much they borrow. A great example of this is your home equity line of credit also referred to as HELOC. With some forms of open-end credit theres no end date.

Open-end loans offer you the chance to borrow as much or as little money as you want up to a certain amount and then pay back some or all of the funds monthly. Youll find it in 102616 b. A home equity line of.

Examples of open-ended loans include lines of credit and credit cards. Examples Examples of closed-end loans typically appear in installment loans. The loan has a term of 30 years with a fixed interest rate of 475.

Personal loans are also often close-end. Instead he may choose to take only 250000. A credit limit is the highest sum of money that one can borrow at any point.

Consider a borrower who gets approved for an open-end mortgage with a 30000 limit. Real estate and auto loans in general are closed-end loans. An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related improvements as needed.

Triggering Terms 102616 b. If any of the following terms is set forth in an advertisement the advertisement must include the additional disclosures described in D2. The following is from our training manual on Advertising.

As you repay what youve borrowed you can draw from the credit line again and again. For example assume a borrower obtains a 400000 open-end mortgage to purchase a home. So there you have it.

Mortgages auto payments and student loans are the most common. Any Borrower may sign a Loan Draft payable to any person or entity that accepts. With open-end loans like credit cards once the borrower has started to pay back the balance they can choose to take out the funds againmeaning it is a revolving loan.

Personal lines of credit and credit cards. Open End Loan Example HELOC. Credit cards and a home equity line of credit or HELOC are examples of open-end loans.

Open-end mortgages can provide flexibility but limit you to what you were initially approved for. Common examples of open-end credit are credit cards and lines of credit. For example assume a borrower obtains a 200000 open-end mortgage to purchase a home.

Although the borrower has been approved for the full 400000 he does not have to take the full amount upfront. An open-ended loan is an extension of credit where money can be borrowed when you need it and paid back on an ongoing basis such as a credit card. Theres no end date for this type of loan.

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

What Is Open End Credit Experian

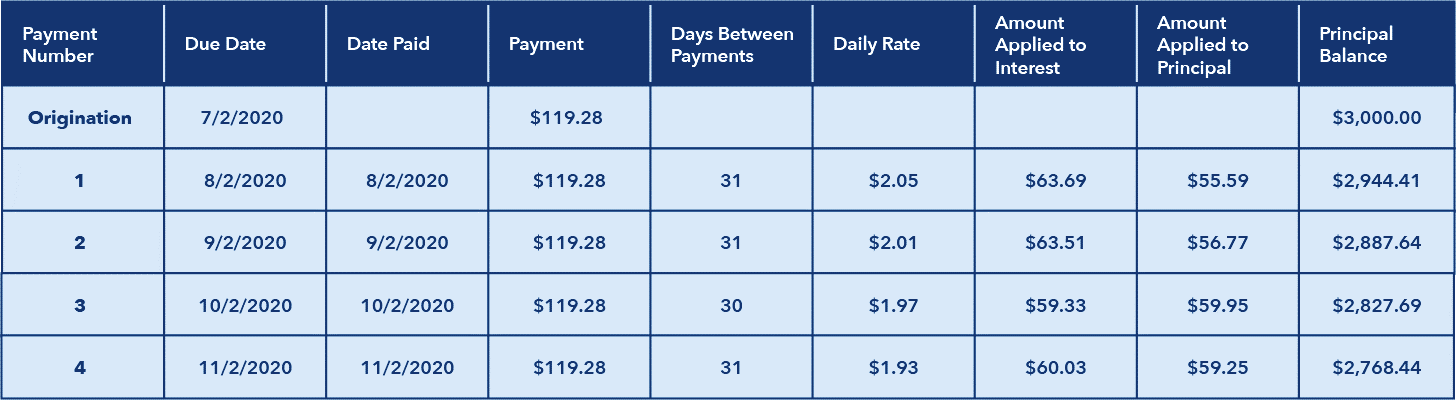

How Daily Simple Interest Works

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

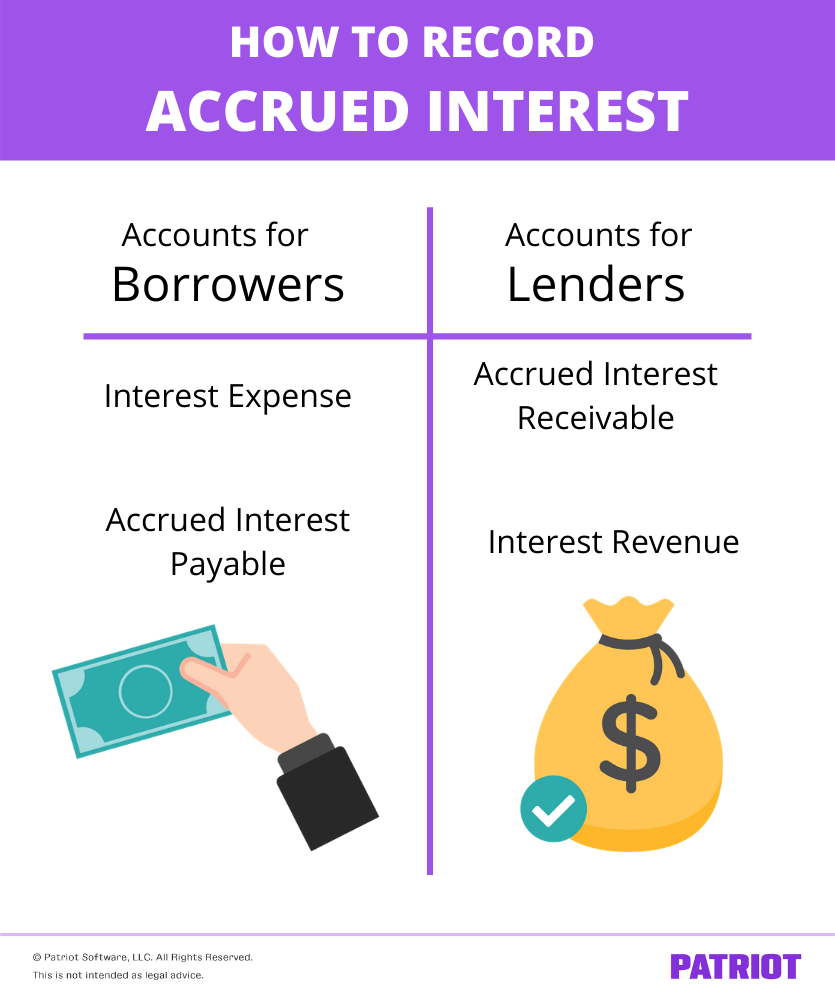

How To Record Accrued Interest Calculations Examples

Simple Loan Application Form Template Elegant Loan Application Form Loan Application Application Form Application

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

Chapter Open Ended Credit An Agreement To Lend The Borrower An Amount Up To A Stated Limit And To Allow Borrowing Up To That Limit Again Whenever Ppt Download

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

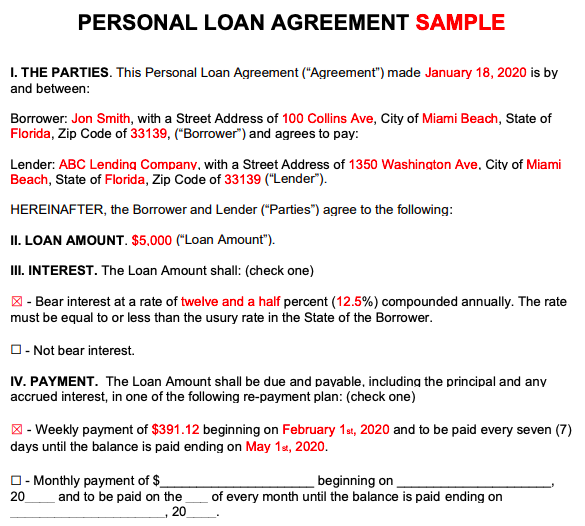

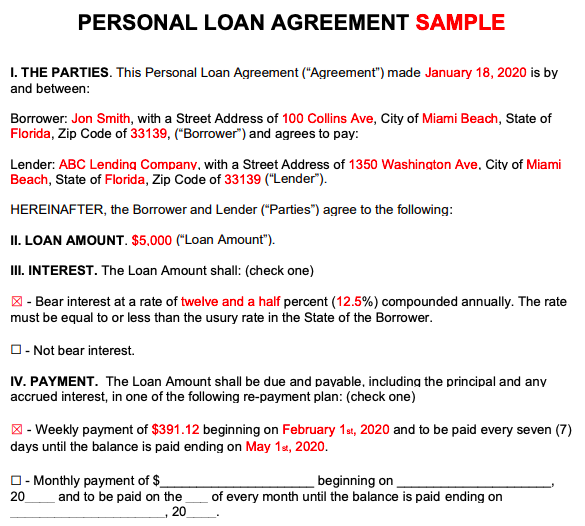

Personal Loan Agreements How To Create This Borrowing Contract

Understanding Finance Charges For Closed End Credit

Consumer Loan Types And Categories Of Consumer Loan With Example

Truth In Lending Act Tila Consumer Rights Protections

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)