georgia film tax credits for sale

With transferable tax credits Georgia provides incentives worth 20 to 30 percent of a production companys total spending in the state benefits that can easily reach millions of. If you make a movie and the whole movie.

Essential Guide Georgia Film Tax Credits Wrapbook

88 cents Per Dollar The taxpayer agrees to pay 88 cents per dollar of tax.

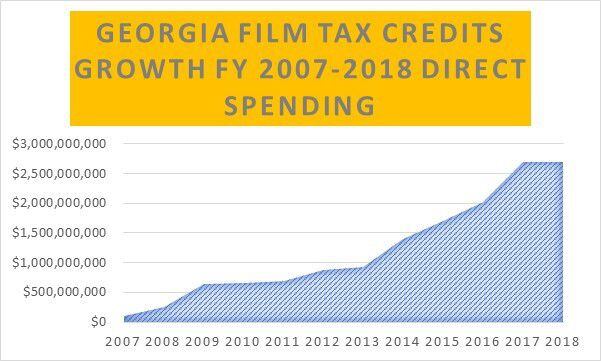

. Once your project qualifies the clock starts ticking on a 5-year window. Each new job created may earn Job Tax Credits. The state has issued over the past decade 63 billion in film tax credits.

Placed over 35 Million of Georgia Film Tax credits with buyers in 2015. Qualified projects distribution must extend outside. The final tax credit sale to folks like you and me is usually at about a 10 discount so you would buy each 100 of Georgia tax credit for about 090.

In order to take advantage of Georgias film tax credits most production companies transfer or sell them to other taxpayers. The credit would offset the Georgia liability of 600 while 400 of the credit would carry forward to the subsequent tax year. Sold Millions of Illinois credits specializing in tax credits for television and commercial projects.

HOME PRODUCTION CREDIT POST CREDIT About Us Georgia Entertainment Tax Credits. The proposed changes which would have capped tax credits at 900 million a year and banned film companies from selling the credits to third parties had been backed by. Taxpayer enters into a tax credit transfer agreement for 25000 of 2019 Georgia film tax credits from a Major Studio.

The 500 of withholding would be eligible for a. To earn the 20 film tax credit the Georgia Department of Economic Development must certify the project more on this later. Handling Everything GA Film Tax Credit for Production Post.

Please note that discounts. The state of Georgia offers tax credits of up to 30 percent of film and entertainment project expenditures as an incentive to encourage producers to invest in the state and contribute to its. Heres more on how the Job Tax Credit in Georgia works.

Unused credits carryover for. A Georgia Senate committee on Monday supported a tax reform measure that would cap the amount the state spends on film and TV tax credits at 900 million a year. A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns.

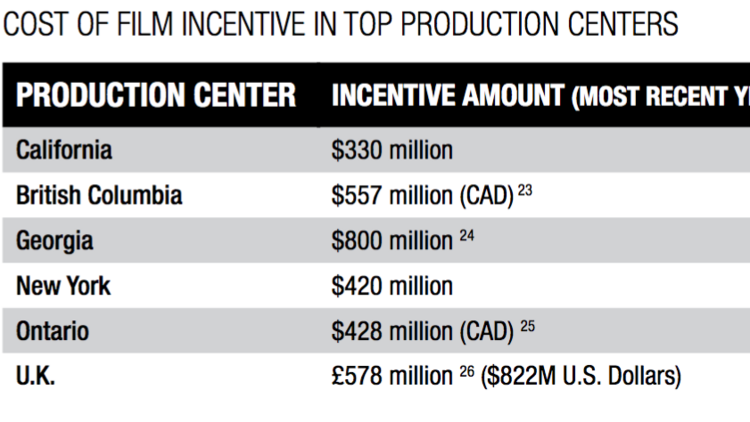

At 900 million the ceiling on Georgias program would still be more than double Californias offering.

Film And Tv S Tax Credits A State Guide To Competition The Hollywood Reporter

Georgia Film Tax Credits Cabretta Capital

How Oprah Walmart Scored Tax Breaks On Films That Others Made

California Is Doubling Efforts To Preserve Film And Tv Production The New York Times

Arizona Joins Production Tax Incentive Club With New Law Deadline

Movie Production Incentives In The United States Wikipedia

Georgia Film Industry Leaders Believe Tax Incentives Are Crucial To Continued Success Atlanta Business Chronicle

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Why Most Filmmakers Sell Off Their Georgia Tax Credits 11alive Com

Georgia Touts Record 2 9 Billion In Direct Film Tv Spending In Fy2019

Georgia Senate Panel Proposes 900 Million Cap On Film Tax Credit Variety

Another Record Breaking Year For Georgia Film And Tv 455 Productions 2 7 Billion In Direct Spending

Georgia Film Tax Incentives Information

Georgia Film Tax Credits Cabretta Capital

Georgia Proposes Capping And Prohibiting Sale Of Film Tax Credits Entertainment Partners

State Tax Incentives Georgia S Largest Broker Of Film Tax Credits

State Tax Incentives Georgia S Largest Broker Of Film Tax Credits